NSHE Grant-In-Aid

Applying for Grant-in-Aid Through Workday

From the Search tool, Enter the keywords “Create Request”.

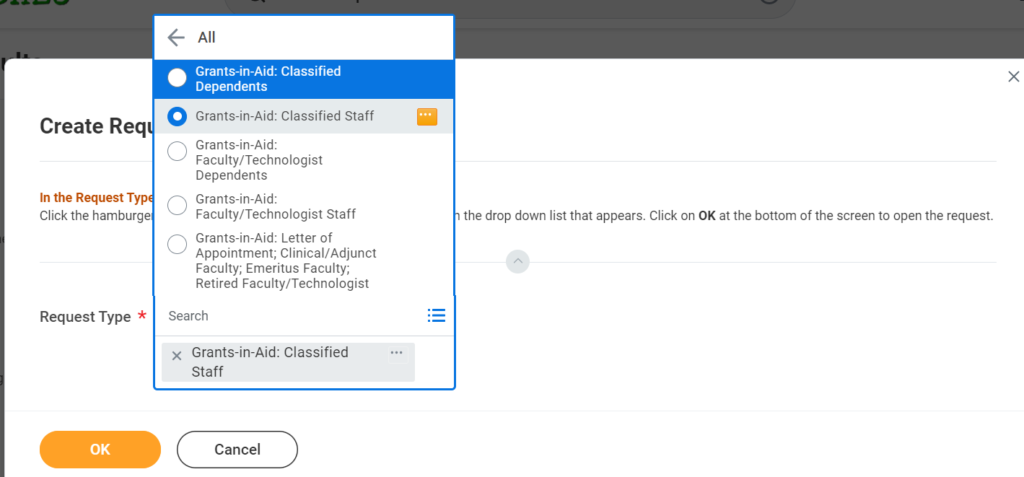

Select All, then select the appropriate Grants-in-Aid request option for your employee classification.

You will be presented with a form in Workday. Complete the questionnaire and submit the application.

After completing the application you can track the status of your request through Workday.

Classified and Professional staff may process their Grant-In-Aid application through Workday. Below provides step-by-step instruction on how to do so. The guidance assumes you are logged into Workday using your NSHE account.

Forms

Additional Information and Considerations

Courses taken by classified employees are subject to the provisions of NRS 284.343 and NAC 284.482 through.

This form is to be used for requesting approval to take NSHE credit courses and to request reimbursement at the close of the semester per the terms of this policy.

Tuition will be reimbursed to classified employees providing the course will improve job performance and/or update the employee’s skills, knowledge and techniques in the current position and/or be beneficial to the

The immediate supervisor and appointing authority approve the taking of job related courses. The System Administration Human Resources Office will certify if the employee is eligible for tuition reimbursement.

A “Request for Tuition Reimbursement for Classified Staff” form must be completed by the employee and approved prior to registration by the immediate supervisor and the appointing authority. Prior to registration the form needs to be approved by the System Administration Reno Office.

The employee is required to pay for the courses at the time of registration and will be reimbursed for tuition expenses after providing evidence that the course was successfully completed with a grade of “C” or better, (or “pass” in the case of pass/fail courses.

For full-time permanent employees, the maximum reimbursement is limited to 6 credits per fall and spring semester and 3 credits per summer session. For part-time (50% or above) permanent employees, reimbursement is limited to 3 credits per fall and spring semester and 3 credits per summer session.

Upon successful completion of the course, the employee submits the original receipts, and a copy of the grade report to the System Administration Office for processing of their reimbursement.

Registration and directly related fees (i.e., per-credit-hour fees and laboratory fees) will be reimbursed to the employee from a central account following the semester in which the course was taken. Books, supplies, and other related costs are the employee’s responsibility.

The reimbursed cost of tuition for graduate level courses is considered income and is subject to federal income tax withholding.